cap and trade vs carbon tax canada

Cap and Trade vs. It further noted that the rise in exports is contributed by high growth in petroleum oil and lubricants POL exports constituting about 15 of total exports as well as non-POL exports.

Unlike the cap-and-trade system described above the emissions reduction outcome isnt predefined with carbon taxes.

. Carbon taxes have also been used in a few local governments in the United States and. The fund selects stocks with a tilt toward a smaller carbon footprint as measured by lower greenhouse gas and carbon emissions relative to sales and. This is remarkable in view of moderation in global trade growth elevated shipping rates and persistent problem of container shortages says the governments annual economic survey.

More to the point. 1335 Invest Now. What is a cap-and-trade system.

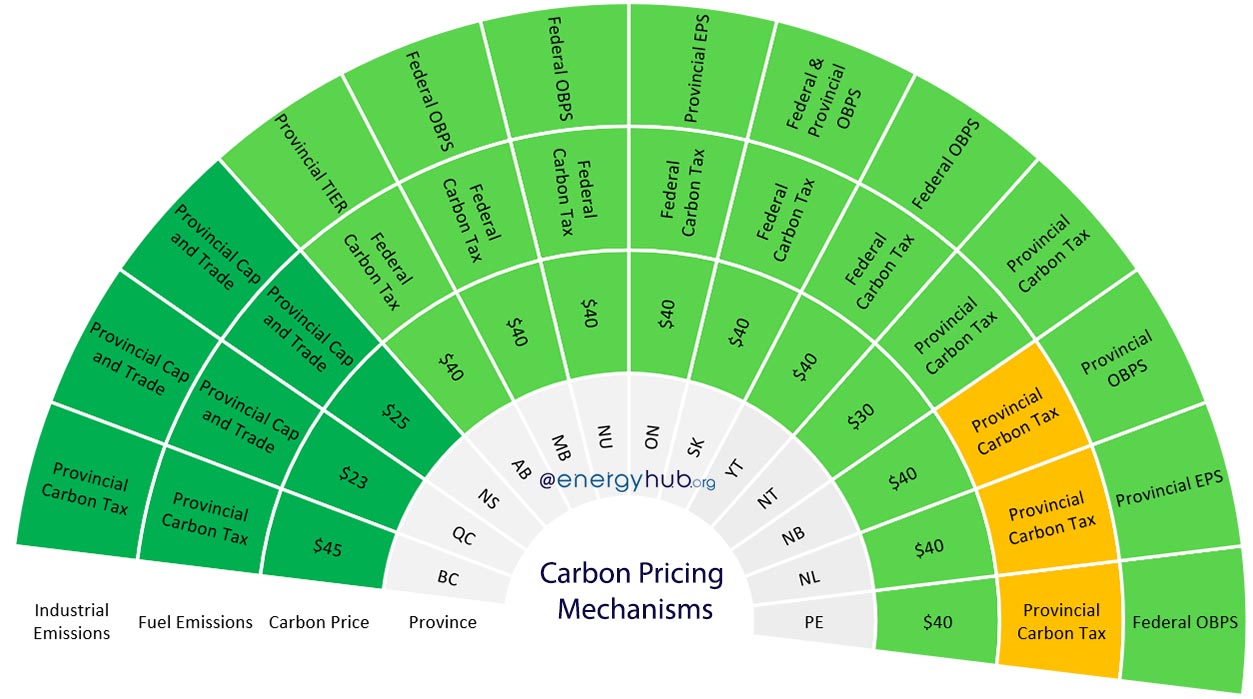

In British Colombia Canada the main proceeds of Carbon pricing go directly to firms households making the carbon tax quite popular amongst important political constituencies. Free ratings analyses holdings benchmarks quotes and news. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions.

Border carbon adjustments are appraised as a measure to address carbon leakage and competitiveness concerns. Oil India Ltd 25355 89. A carbon tax is a fee imposed on the burning of carbon-based fuels coal oil gas.

Cap and trade is also being used in three regional trading programs in the United States and Canada. A carbon tax is a way the only way really to have users of carbon fuels pay for the climate damage caused by releasing. It encourages carbon emissions trading by allowing states that emit less than the caps to trade their surplus to states that emit more than the cap.

A federal judge recently blocked a huge oil and gas lease sale in the Gulf of Mexico for environmental reasons but it may have hurt the oil industrys carbon capture efforts. This sets a cap on the total greenhouse gas. Additionally there are also other indirect ways to price carbon such as taxing fossil fuels or removing fossil fuel subsidies.

NSE Gainer-Large Cap. Carbon tax and replicating this policy across the globe. And Alberta use carbon taxes as part of their strategies to reduce emissions and encourage investments in energy-efficiency and renewable energy.

To comply power plants will create 30 more renewable energy by 2030. Under the expansion taxpayers can use the credit to offset the states tentative minimum tax. FEATURED FUNDS Mirae Asset Equity Savings Fund Direct - Growth.

It does this by setting carbon reduction goals for the nations power plants. A carbon tax is the core policy for reducing and eventually eliminating the use of fossil fuels whose combustion is destabilizing and destroying our climate. Carbon tax vs carbon trading whats the difference.

Carbon taxes can also set a direct price on carbon as they establish a tax rate on GHG emissions. ZeroHedge - On a long enough timeline the survival rate for everyone drops to zero. In a cap-and-trade system government puts a firm limit or cap on the overall level of carbon pollution from industry and reduces that cap year after year to reach a set pollution.

Carbon pricing or CO 2 pricing also known as cap and trade CAT or emissions trading scheme ETS is a method for nations to reduce global warmingThe cost is applied to greenhouse gas emissions in order to encourage polluters to reduce the combustion of coal oil and gas the main driver of climate changeThe method is widely agreed and considered to be efficient. A Green New Deal funded. Ukraine and Russia together account for more than a quarter of global trade of the staple used in everything from bread to cookies and noodles.

This Review Article discusses the possible impacts as well as practical challenges for. The use of taxes aimed at reducing GHG emissions has initially been used in several countries including Norway Sweden and Germany that are now relying increasingly on emissions trading. By contrast Australias short-lived carbon tax 2012-14 suffered from lack of political understanding and poor communication about who benefitted from it.

Suppose you have invested in a fund that tracks the SP 500 Index that tracks the performance of the top 500 large-cap publicly traded companies in the US stock market and hedges it against the Canadian dollar. Each approach has its vocal supporters. Learn everything about Global X NASDAQ 100 Covered Call ETF QYLD.

The Carbon Tax Center was founded in 2007 on the belief that the most direct path to decarbonize the world economy lay in enacting a robust US. Popularity of Carbon Pricing. The SALT cap workaround was enacted in 2021 allowing entities taxed as S corporations or partnerships to elect to pay a 93 state income tax and their owners to claim a credit on their personal income taxes equal to the tax the entities pay.

Those in favor of cap and trade argue that it is the only approach that can. An ETS as seen in the EU is usually in the form of a cap-and-trade system. In that case a 10 gain in the index would directly reflect in 10 gains for the fund minus expenses.

A dozen years on we hoped to expand our program around a new synthesis. Based on the Law 72021 the imposition of carbon tax will be carried out by focusing on two specific schemes ie the carbon tax scheme cap and tax and the carbon trade scheme cap. Carbon tax provisions are regulated in Article 13 of the Law 72021 in which carbon tax will be imposed on entities producing carbon emissions that have a negative impact on the environment.

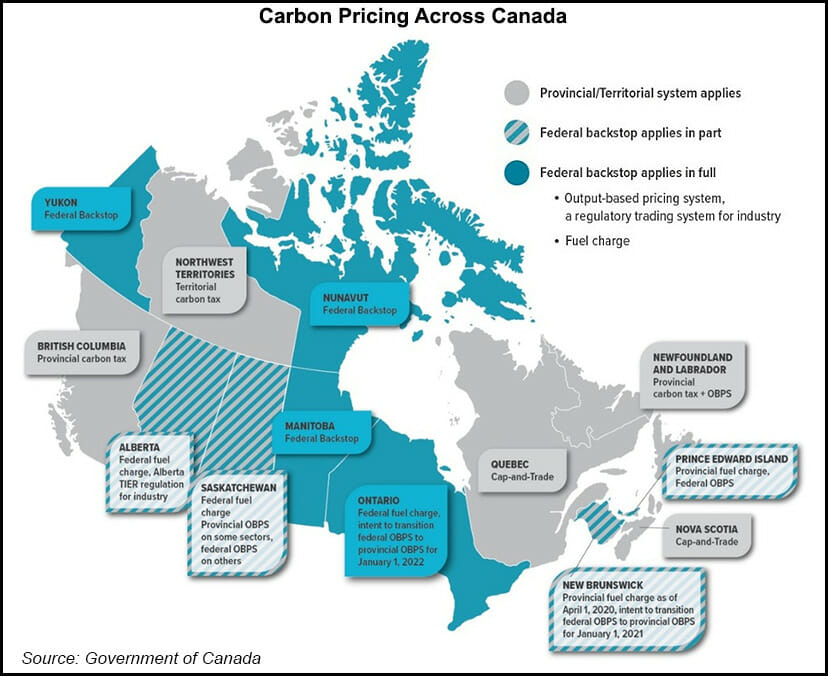

Your Cheat Sheet To Carbon Pricing In Canada Delphi Group

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

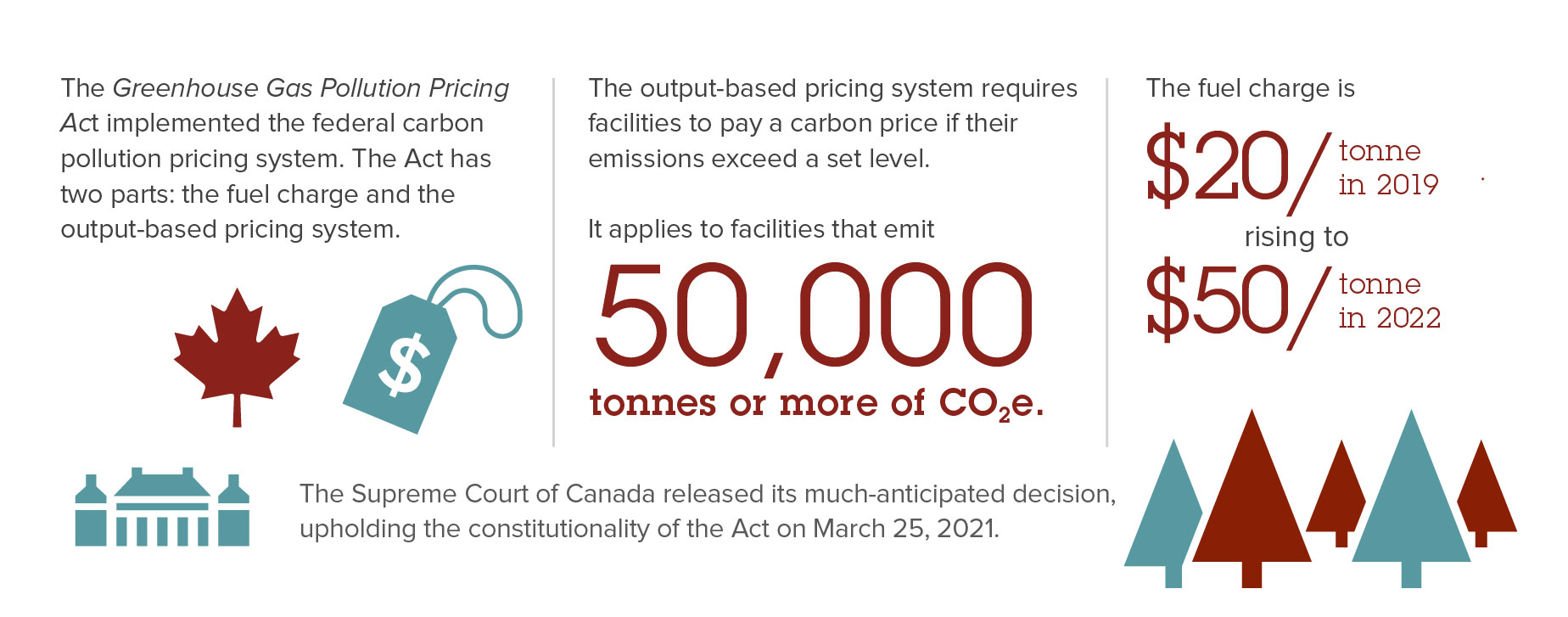

Federal Government S Carbon And Greenhouse Gas Legislation Canada

Dear Corporate Canada It S Time To Pay For Your Part In Climate Change Guardian Sustainable Business The Guardian

Climate Income A K A Carbon Fee And Dividend Citizens Climate Lobby Canada

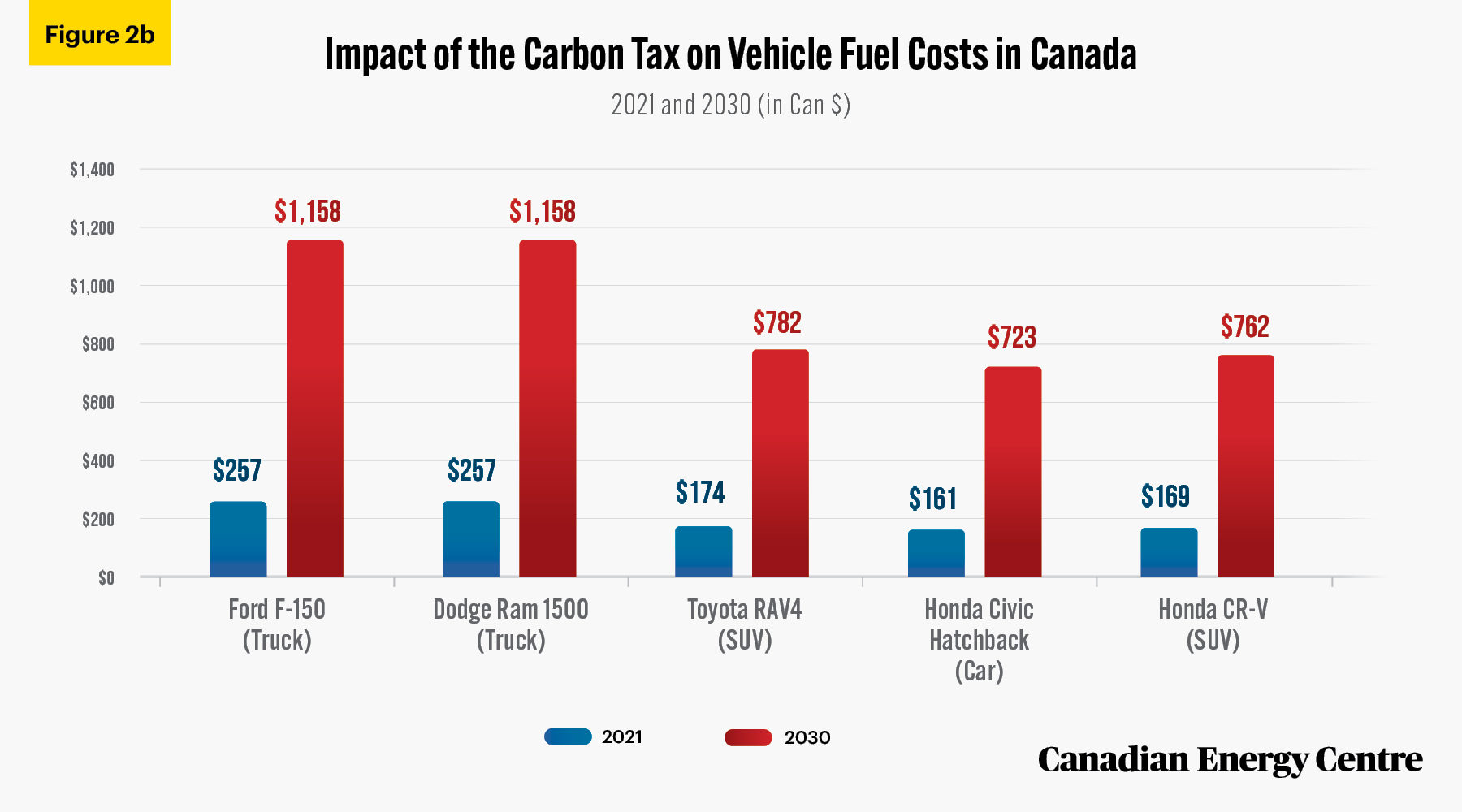

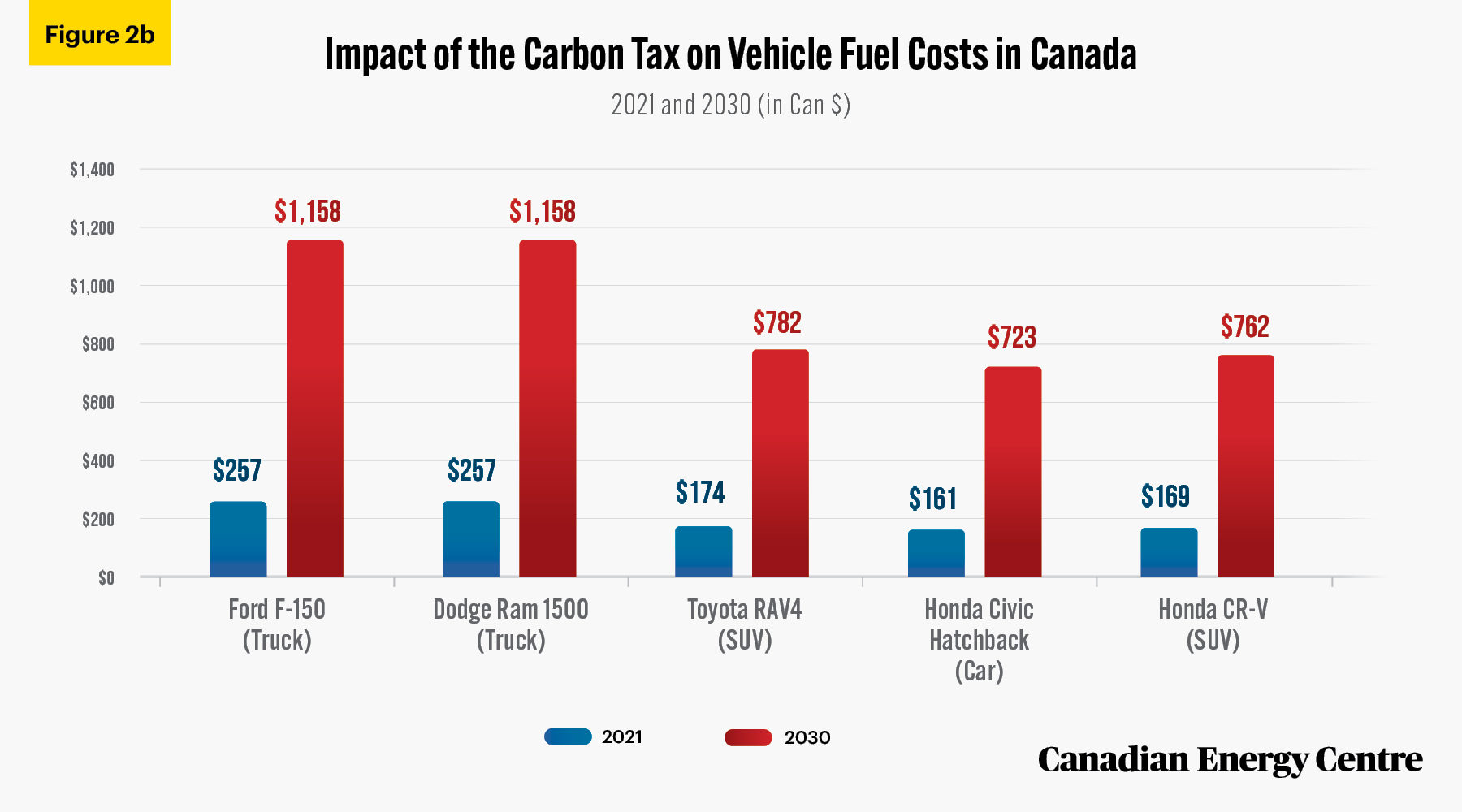

Up To 350 Per Cent Higher At The Pump By 2030 The Impact Of Higher Carbon Taxes On Gasoline Prices Canadian Energy Centre

Canadian Carbon Prices Rebates Updated 2021

Pin By Yvonne Williams On Canada Oh Canada Cap And Trade Gas Prices The Province

Climate Income A K A Carbon Fee And Dividend Citizens Climate Lobby Canada